Manufacturing Q&A

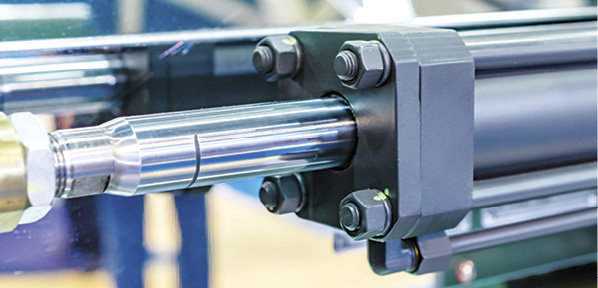

Shirish Pareek is the founder and CEO of Hydraulex Global, a corporation that specializes in worldwide remanufacturing, repair, and distribution of major-brand hydraulic pumps, motors, valves, servos, and cylinders. Hydraulex Global employs over 400 personnel in the U.S. and Canada within their companies of Attica Hydraulic Exchange, Metaris Hydraulics, Hydraulic Repair and Design, and Flint Hydrostatics. Shirish is a member of the U.S. Manufacturing Council serving on the principal private sector advisory committee to the Secretary of Commerce on the United States manufacturing sector. He is also owner and board member of MinnPar, a heavy-equipment parts supply business.

Shirish Pareek is the founder and CEO of Hydraulex Global, a corporation that specializes in worldwide remanufacturing, repair, and distribution of major-brand hydraulic pumps, motors, valves, servos, and cylinders. Hydraulex Global employs over 400 personnel in the U.S. and Canada within their companies of Attica Hydraulic Exchange, Metaris Hydraulics, Hydraulic Repair and Design, and Flint Hydrostatics. Shirish is a member of the U.S. Manufacturing Council serving on the principal private sector advisory committee to the Secretary of Commerce on the United States manufacturing sector. He is also owner and board member of MinnPar, a heavy-equipment parts supply business.

Jim Burke is vice president, sales and marketing, for Zinga Industries, Inc. The company has manufacturing capabilities in aluminum die casting, mold making, machining, fabricating, assembly, and silk screening. Jim has 35 years of experience, including positions at Gresen Hydraulics (Dana) and Parker Hannifin. He has been with Zinga for 11 years. The Zinga product line includes suction strainers and diffusers, spin-on filter heads and adapters (single and modular), in-tank filters, high-pressure filters (cartridge and spin-on), cellulose and synthetic elements, check and ball valves, gauges, and reservoir accessories.

Jim Burke is vice president, sales and marketing, for Zinga Industries, Inc. The company has manufacturing capabilities in aluminum die casting, mold making, machining, fabricating, assembly, and silk screening. Jim has 35 years of experience, including positions at Gresen Hydraulics (Dana) and Parker Hannifin. He has been with Zinga for 11 years. The Zinga product line includes suction strainers and diffusers, spin-on filter heads and adapters (single and modular), in-tank filters, high-pressure filters (cartridge and spin-on), cellulose and synthetic elements, check and ball valves, gauges, and reservoir accessories.

Michael Olinger is director of operations, North America, for Danfoss Power Solutions and has been serving the fluid power industry with Danfoss for nearly 29 years. In his current role, Michael utilizes his manufacturing expertise in day-to-day operations. Michael’s experience stems from his 29-year tenure with Danfoss and his experience in previous roles, when he served as marketing manager, operations manager, and in program development.

Michael Olinger is director of operations, North America, for Danfoss Power Solutions and has been serving the fluid power industry with Danfoss for nearly 29 years. In his current role, Michael utilizes his manufacturing expertise in day-to-day operations. Michael’s experience stems from his 29-year tenure with Danfoss and his experience in previous roles, when he served as marketing manager, operations manager, and in program development.

Do you think a manufacturing renaissance has staying power with manufacturing and jobs coming back to the United States?

Pareek: I believe the resurgence has staying power and for several reasons. American companies moved too quickly to follow the trend in the mid-1990s and early 2000s to move jobs out of the United States. The customer aspects of quality, speed-to-market, and new product introduction are much easier when you are doing it here. American companies are now realizing that they need to focus on total cost, not just product price. The inexpensive unit price of manufacturing an item outside the United States isn’t necessarily the lowest overall cost when you take into consideration shipping fees, longer lead times, the quality, and communication challenges. Whereas if you are manufacturing in the United States, your lead times are shorter, you can work on quality issues easier, your communication is easier, and your transportation is cheaper.

Burke: Yes, because of two major factors: consistent quality of the products and timely product availability.

Olinger: Many of our customers are requesting products that are sourced in the regions they are located in, so a key to the staying power starts with U.S. market demand. Assuming the demand for our products is there, the resurgence of manufacturing in the U.S. should continue trending upward. We are fortunate to have a productive workforce with a strong work ethic in Iowa. A productive workforce combined with investments in newer manufacturing technology will be a catalyst for continued improvement for U.S. manufacturers.

Do you think that U.S.-based companies are poised for significant growth in 2015?

Pareek: I do see the mid-term trend favoring manufacturing growth in the United States as more and more companies are realizing that it is easier to control quality, reduce lead times, and keep freight costs low when keeping production close to home. In addition, our newfound abundance of natural gas helps in reducing production energy costs in manufacturing. It is a component in so many products and services that it provides a positive impact on countless manufacturing processes for the United States.

Burke: Growth yes, but I would choose marginal reserved growth.

Olinger: There are certainly signs of positive business trends as we progress through 2014. The agricultural market segment has played a key role in our manufacturing growth since the economic downturn in 2009. Agriculture commodity prices are coming down from their highs, and we are beginning to see some softening in the agriculture segment. Renewed strength in the agriculture market, along with exchange rates and U.S. housing starts, will all impact the significance of any growth in 2015. Labor rates are equalizing globally, and this helps level the playing field for labor content in any manufactured product. Customer quality expectations are increasing, and the ability of U.S. manufacturers to respond by continuously improving quality and delivery performance will enhance our ability to outpace manufacturing growth in other regions.

Which product segments of the hydraulics manufacturing market do you see growing? Which segments do you see diminishing?

Pareek: As more manufacturing comes back to the United States, I firmly believe that the industrial side of hydraulics will be growing. As industrial manufacturing grows, that means more stamping, casting, forging, and extrusion, which equates to an increased need for industrial hydraulics. Another segment would be remanufacturing. At Hydraulics Global, we see this segment growing, especially as more global corporations are becoming environmentally conscious. Remanufacturing is green and is good for the environment. Companies are getting more comfortable with remanufacturing units made in the United States with American labor.

Burke: I see growth in pumps, valves, cylinders, and filtration. Product segments I see diminishing are those that do not offer innovation and consistent quality at a competitive price.

Olinger: There are several segments of the hydraulics market that will grow over the next few years. Hydraulic fan drive systems will continue to grow and help OEMs cool Tier IV engines. Many OEMs continue to update their equipment with displays, joysticks, and other electronic components to improve the machine productivity by providing operators with more information. Future demands will drive the need for hydraulic components that can be integrated with electronics and software to meet customer requirements. We anticipate this trend to continue to accelerate within the mobile hydraulics industry. The market for direct displacement controls for hydrostatic pumps is expected to continue to decline as customers integrate electronic control features in their machines.

What do you think the greatest threat to manufacturing growth will be in the next 6-12 months?

Pareek: The greatest threat to manufacturing growth is finding skilled workers, such as engineers, technicians, CNC operators, assembly line workers, etc. As manufacturing starts to increase, finding a significant number of good, qualified employees is a challenge and can hamper the capacity for growth or expansion plans. There just aren’t enough new/younger people going into these trades to support the growth.

Burke: Political uncertainty, negative media influence, and environmental disasters are all influential in business-decision processes. There has been growth of the business community, but it has been reserved.

Olinger: Attracting and retaining experienced manufacturing support personnel is stretching our supply base resources and our internal resources. Improvements in manufacturing productivity and the implementation of new manufacturing technologies are typically paced by the availability of supplier resources and our own experienced team members. Improving our ability to share best practices globally will help us leverage the experience of our teams.

Do you think there is a skills gap in not having enough qualified workers to produce the components that you manufacture?

Pareek: Clearly there is a skills gap problem in the United States, and it’s a big challenge. Within our five locations at Hydraulex Global throughout North America (Detroit, Seattle, Memphis, Forest, Mich., and Toronto, Canada), I find it difficult to fill jobs. In the United States, we currently have a short supply of qualified people who are trained in trade skills. Exacerbating this problem in the next few years, approximately 2.7 million baby boomers will retire from manufacturing jobs, further increasing the skills gap and labor shortage. The skills gap will only keep increasing if companies don’t take the responsibility of training employees. We need to invest in developing, training, and creating the manufacturing workforce for the future. Workforce development is critical. At Hydraulex Global, the approach we have taken is hiring people and then training them ourselves in the necessary skills.

Burke: Yes. The lack of basic training starting at the high school level is a beginning point. Students at the high school level need exposure to the potential opportunities not only in fluid power, but also in all of the skilled trades. The skilled trades can provide a solid means of employment, income, and a meaningful future.

Olinger: Our Ames, Iowa, facility is located in an area with one of the lowest unemployment rates in the country. Turnover of our temporary workforce is high, and we invest a tremendous amount of time in training. We continue exploring opportunities to improve the flexibility of our workforce in an effort to sustain desired productivity levels through the seasonality of our business. Our colleagues in Germany are fortunate to have an apprenticeship program that allows them to focus on training individuals with a desire to build a career in the manufacturing sector. Here in the United States, it is often challenging to find individuals with a desire to remain in manufacturing long term. The manufacturing sector may not necessarily be viewed negatively by younger individuals preparing to enter the workforce, but we need to find a way to give it a more appealing image so as to encourage a growing workforce to strive for a longer-termed career in the field. This will also energize our teenagers to pursue development of manufacturing skills.