Manufacturers Struggling with Backlogs

By Michael Degan, Fluid Power Journal Editor

A State of the Fluid Power Industry Survey released by the National Fluid Power Association in January shows that backlogs and long delivery times continue to plague manufacturers and distributors of fluid power products struggling to recover from the pandemic-related disruptions of 2020.

NFPA said that 71% of manufacturers responding to the survey reported an increase in their backlog of unfilled orders from November to December.

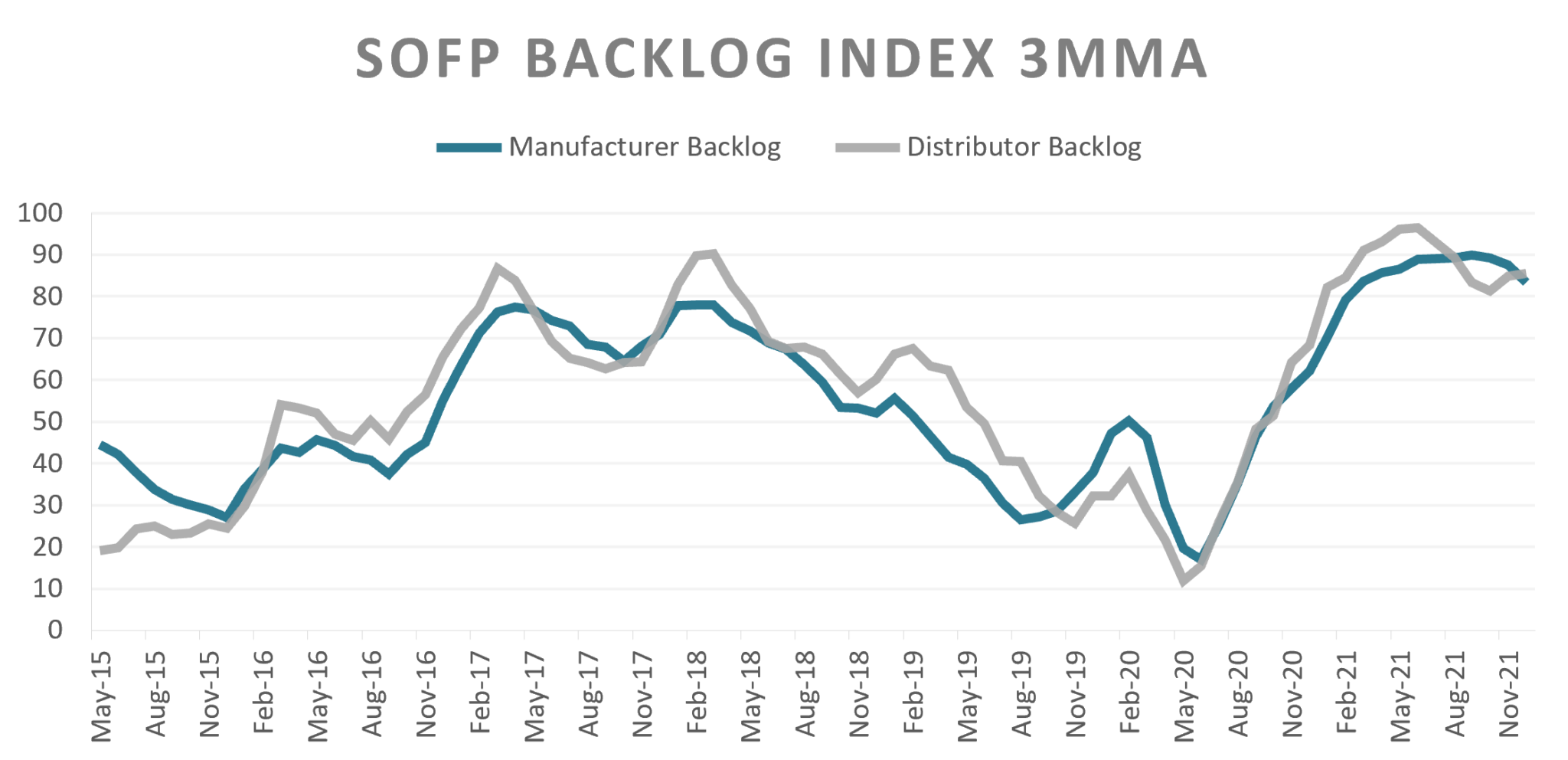

“As seen in the graph below, manufacturers and distributors have been saying relatively the same thing about their backlogs,” NFPA reported. “Over the past year, their backlogs have been overwhelminglyincreasing, though there is some indication of easing for manufacturers.”

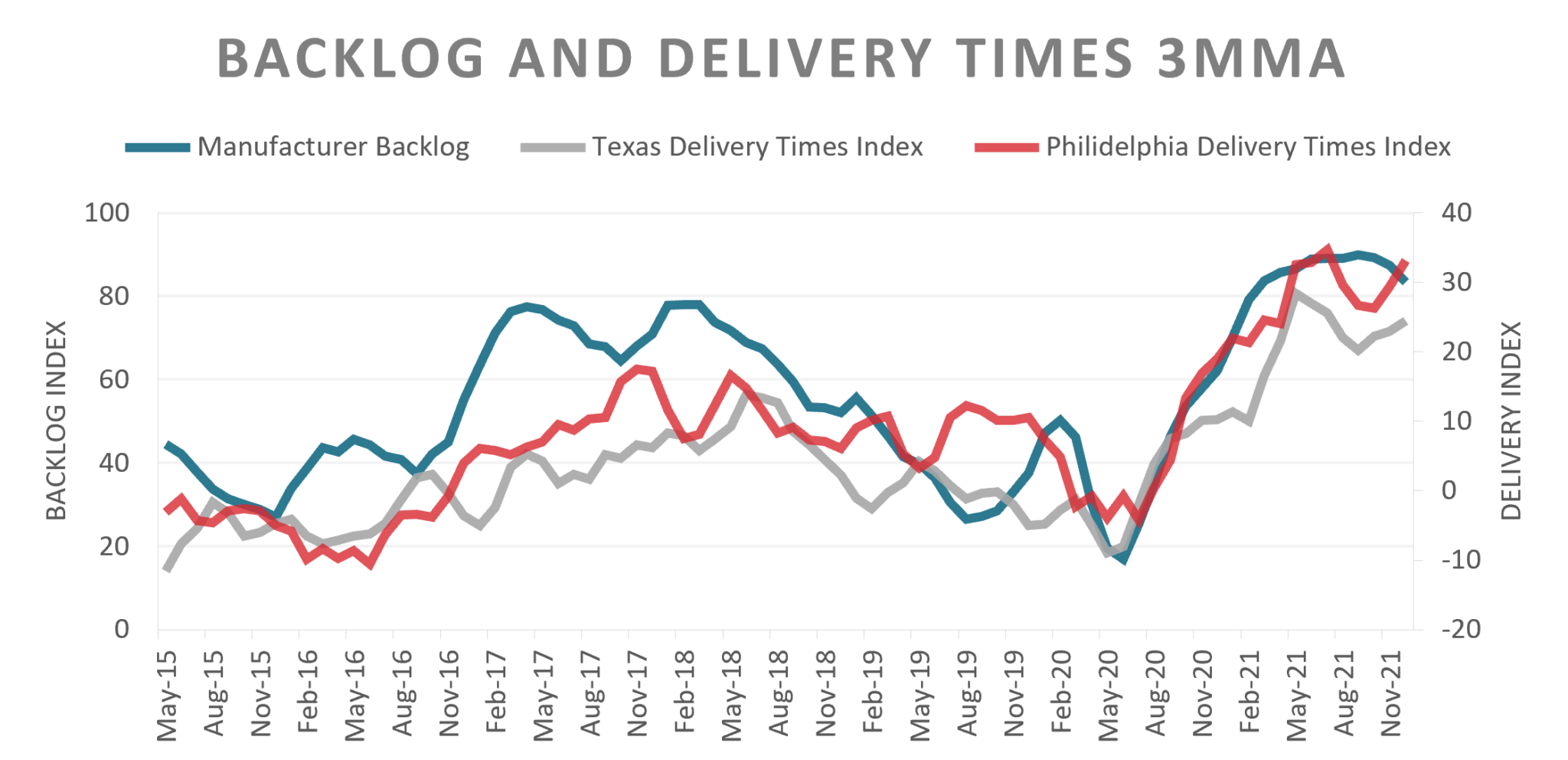

To explain why the backlogs are so high, NFPA compared the manufacturing backlog to delivery time indexes from the Federal Reserve Banks of Texas and Philadelphia.

“These indexes come from regional manufacturing outlook surveys used to indicate direction of change in overall business activities,” NFPA said. “Both delivery time indexes are over 75% correlated with NFPA’s backlog index. The chart below shows how they trend similarly and started increasing around May 2020.”

In its survey, NFPA asked, “When will backlog pressures ease?” For its forecast, NFPA looked at data from the Institute of Supply Management’s Supplier Deliveries Index.

“This index peaked at 78.8 in May 2021,” NFPA said, “and has since started a downward trend. In the latest Global Fluid Power Report and Forecast, Oxford Economics states, ‘although the worst supply-chain disruptions are likely to have peaked, it will take several quarters for pressures to unwind.’ This is consistent with the current trajectory of the Manufacturer SOFP backlog index.”

For more information, visit (https://nfpahub.com/updated-state-of-the-fluid-power-industry-survey-now-available/

The big problem of being a manufacturing company is looking for new creative solutions to keep up with the growing economy.

He replies that the business is trying to be strong, but I am worried about the supply chain disruption we are seeing now.