Manufacturing Contracts, but Is the Worst Over?

Fluid Power Journal Staff Report.

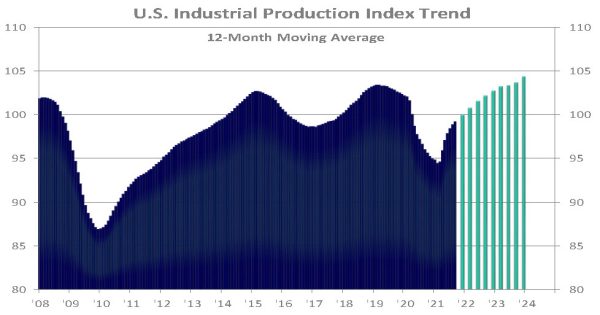

February data continued the trend of contracting growth in manufacturing, but signs of stabilization may indicate that the worst could be over.

The Institute for Supply Management reported a purchasing manager’s index of 47.7 for February. A PMI under 50 is considered contraction in manufacturing. February’s figure is up slightly from January’s 47.4 PMI. That’s the first growth in six months, indicating that the worst may have passed for manufacturing, which is 11.3% of the U.S. economy.

ISM surveys purchasing managers from over 300 manufacturing companies. Economists consider the monthly PMI as a key indicator of U.S. economic growth.

February’s PMI was “the fourth month of slow contraction and continuation of a downward trend that began in June 2022,” ISM reported on March 1.

“Regarding the overall economy,” ISM said, “this figure indicates a third month of contraction after a 30-month period of expansion. In the last two months, the Manufacturing PMI has been at its lowest levels since May 2020, when it registered 43.5 percent.”

“The U.S. manufacturing sector again contracted,” ISM said, “with the Manufacturing PMI improving marginally over the previous month. With Business Survey Committee panelists reporting softening new order rates over the previous nine months, the February composite index reading reflects companies continuing to slow outputs to better match demand for the first half of 2023 and prepare for growth in the second half of the year.”

ISM said of the six largest industries, two – transportation equipment, and petroleum and coal products – registered growth in February.

Other industries that showed growth in February were apparel, leather and allied products; and electrical equipment, appliances and components.

Other data indicate that factory production was strong in January and spending by businesses grew this quarter. But inflation remains a concern, as consumers have shown resistance to higher prices.

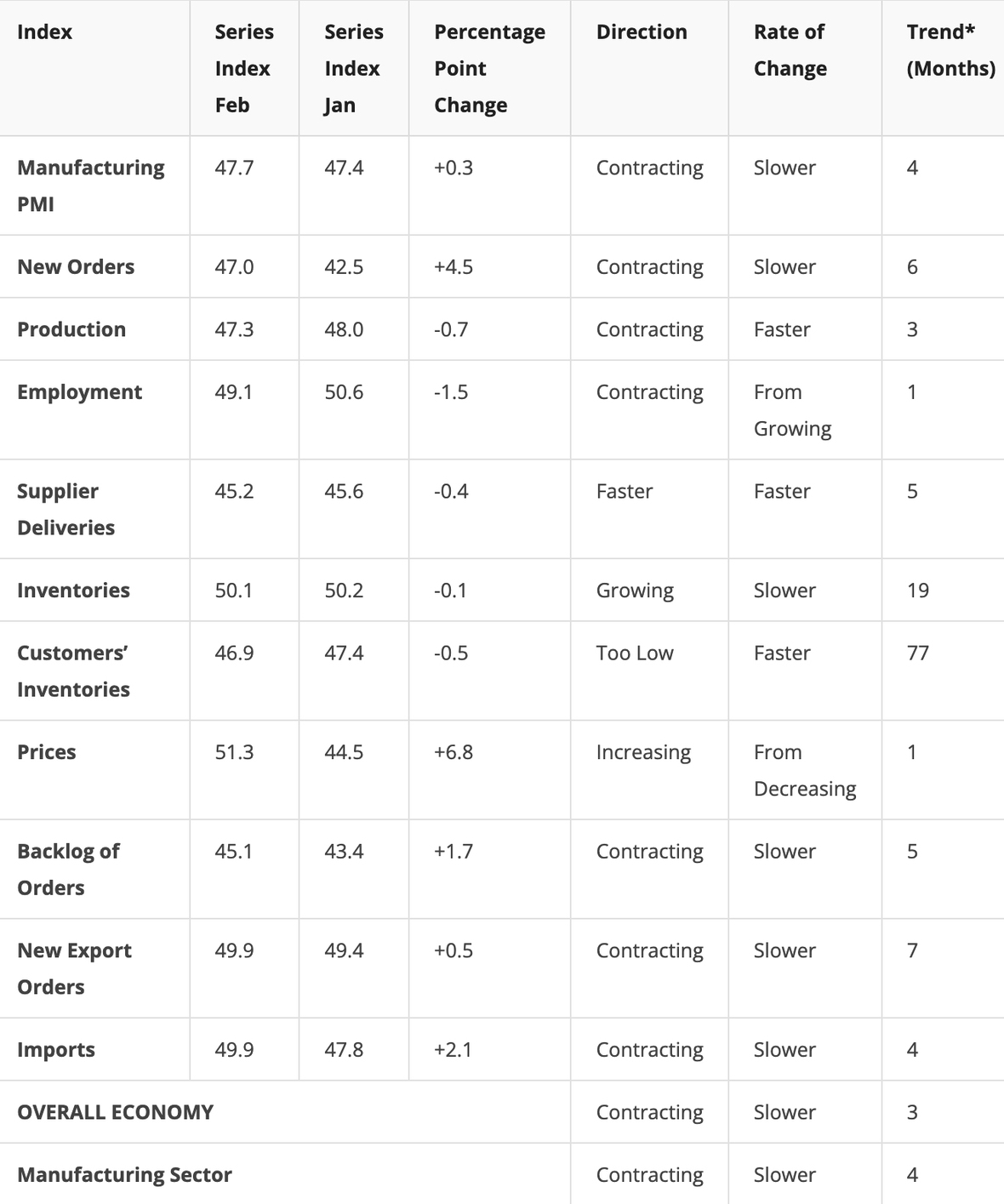

MANUFACTURING AT A GLANCE

February 2023

Source: Institute for Supply Management

Manufacturing ISM Report On Business data is seasonally adjusted for the New Orders, Production, Employment and Inventories indexes.

*Number of months moving in current direction.