Shipments, Exports Down in 2020 Due to Pandemic

NFPA report cites industry’s economic impact—

NFPA report cites industry’s economic impact—

By Michael Degan, Fluid Power Journal Editor

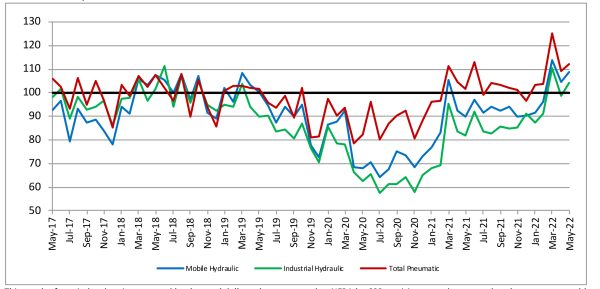

Exports and shipments of fluid power products were down in 2020 compared to 2019 due to the significant economic disruption caused by the COVID-19 pandemic and the resulting shutdowns of businesses worldwide.

Exports and shipments of fluid power products were down in 2020 compared to 2019 due to the significant economic disruption caused by the COVID-19 pandemic and the resulting shutdowns of businesses worldwide.

National Fluid Power Association figures released Aug. 27 in its U.S. Fluid Power Industry Brief show that exports of fluid power products totaled $5.6 billion in 2020, down from $6.6 billion in 2019.

Shipments of U.S. fluid power products ended 2020 at $18.2 billion. Of that total, 75% of shipments were hydraulics products amounting to $13.6 billion. The remaining 25% were pneumatics products, which shipped $4.6 billion worth of goods.

Those figures were down from $22 billion in U.S. shipments in 2019, of which $16.9 billion were hydraulics products and $5.1 billion were pneumatics products, according to the Industry Brief.

The 2020 reductions in exports and shipments of fluid power products were the result of the COVID pandemic, NFPA president and CEO Eric Lanke told Fluid Power Journal.

“Based on the data we’ve seen,” Lanke said, “the drops in exports and shipments seen in the updated report were largely created by issues related to the pandemic, such as supply chain issues and general uncertainty, which caused delays in production and shipments and limited international orders.”

He said that NFPA and other economists expect that the worst of the pandemic-related downturns are behind us.

“The latest NFPA data as well as information from our speakers at the recent Industry & Economic Outlook Conference show that growth is expected overall through 2021 and moving into 2022,” Lanke said.

Economic impact

As an industry, fluid power has a downstream impact on the U.S. economy, the Industry Brief said.

“Key industries that depend on fluid power include construction machinery, agricultural machinery, automotive (including light trucks), class 4-8 trucks (including vocational trucks), material handling (including conveying), industrial machinery, and many more,” the report said.

Based on 2019 figures, the Industry Brief reported that 26% of hydraulics sales were from the construction machinery market, 14% were from agricultural machinery, 11% were from automotive markets including light trucks, 9% were from material handling markets including conveying, and 5% were from oil and gas markets. Those five markets represented 65% of all sales of hydraulics products in 2019.

The top five markets for pneumatics products in 2019 were automotive including light trucks, food processing, packaging machinery, medical equipment, and semiconductor. These markets represented 32% of all pneumatics products sales in 2019.

Based on data collected by the U.S. Census Bureau in 2019, the Industry Brief estimated that the industries that use fluid power products “employ 847,634 people with an annual payroll of at least $60 billion,” it said.

“These fluid power-dependent employers reside in nearly all 50 U.S. states. The ten states with the highest number of employees are Michigan, California, Ohio, Texas, Illinois, Indiana, Kentucky, Pennsylvania, Wisconsin, and Iowa,” the report said.

The Industry Brief estimated that at least 744 companies manufacture fluid power pumps, motors, valves, cylinders, actuators, and hose fittings. Those companies employ 64,936 people with an annual payroll of at least $4.4 billion, according to the Industry Brief.

The figures point to fluid power’s significance to the global economy, Lanke said.

“Fluid power has a huge impact on the world as we know it,” he said, “both economically speaking from all of the industries that it touches, but also in the diverse applications of fluid power technology that are everywhere around us.”

The Industry Brief shows “that the industry is a resilient one that is well equipped to grow and thrive moving into the future,” he said.

The pandemic emergency

On a page with the headline “The Fluid Power Industry’s Response to Adversity,” the Industry Brief noted how fluid power companies responded to the COVID-19 emergency during the early stages of the pandemic in 2020.

“Though many businesses suffered when COVID-19 reached the U.S.,” the report said, “the fluid power industry adapted quickly and remained resilient.” The document noted “some of the ways our industry stepped up and helped during the pandemic.”

The industry’s support included supplying parts for ventilators; helping to produce and distribute masks, gowns, and face shields; aiding in the production of social distance barriers; supplying components for hospital beds and gurneys; keeping up with increased demands in essential industries; and playing a role concerning dredging boats that “helped prepare the New York Harbor for a floating hospital.”

Developing a workforce

Preparing the next generation of fluid power professionals is one of NFPA’s mandates, and the Industry Brief spelled out initiatives aimed at “Developing a Fluid Power Workforce.”

“Fluid power and the industries it serves depend on a highly educated workforce,” the report said.

One of the programs NFPA uses to cultivate that workforce is its Educator Network, which partners with 228 middle schools, 164 high schools, 104 technical colleges, and 90 universities. These institutions teach fluid power to their students, preparing them for potential careers in the industry.

Another program is Fast Track to Fluid Power, which connects local technical colleges with industry partners and high school teachers. “The network creates awareness and interest in fluid power and continues to direct students along a path that leads to careers in the fluid power industry,” the Industry Brief said.

Replacing annual reports

The U.S. Fluid Power Industry Brief is replacing NFPA’s annual reports. The Industry Brief will be issued every two years, NFPA said in a press release. Lanke said the changes coordinate better with other data NFPA puts out on the state of the industry, particularly the Technology Roadmap that NFPA released on Aug. 17.

“The changes in the report’s name and frequency,” Lanke said, “came about to both better reflect the content of the report as well as to bring it more in line with NFPA’s Technology Roadmap, which is refreshed every two years with direct input from various stakeholders within the fluid power industry and its customer markets. In their current states, the Technology Roadmap serves as a robust source of information about the opportunities and strengths in the fluid power industry, while the Industry Brief presents the industry’s strengths in an easily digestible and readily shareable format.”

To download the Industry Brief, visit www.nfpa.com/home/industry-stats/Industry-Brief.htm.