Slowing Growth Forecast for This Year

Labor market, supply chain concerns continue

Labor market, supply chain concerns continue

From the National Fluid Power Association and ITR Economics

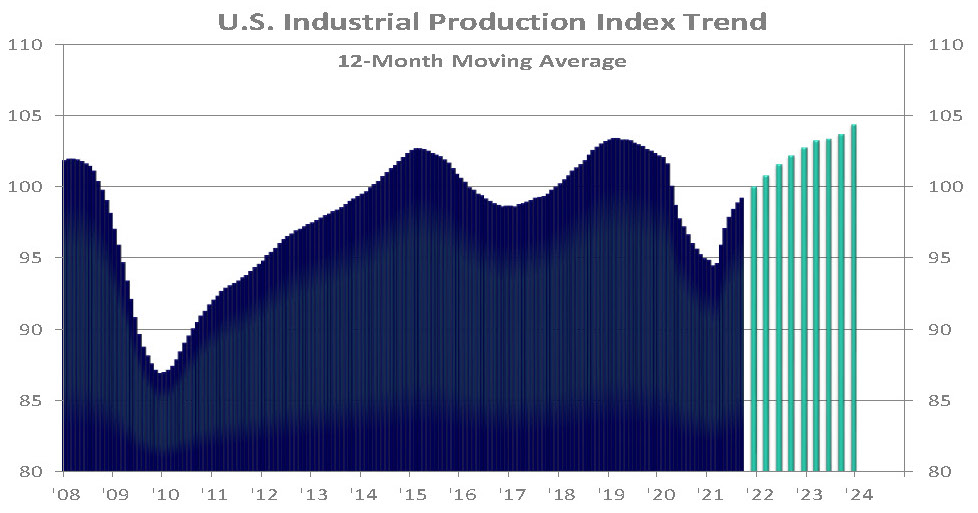

Sharply rising activity has been the prevailing trend in the U.S. macroeconomy since the middle of 2020. U.S. industrial production is in an accelerating growth trend, and U.S. real gross domestic product rose by a near-record 12.2% from the second quarter of 2020 to the second quarter of 2021.

However, the vast majority of the key leading indicators are now in declining trends, signaling slowing growth on the horizon. Our outlook calls for slowing U.S. real GDP growth throughout 2022 and into the middle of 2023. We expect slowing growth in U.S. industrial production during the majority of 2022-23. Ensure you are not expecting the rates of rise experienced in 2021 to occur in 2022-23 if your business moves closely with real GDP or industrial production.

This year’s slowing growth is not a sign of a weakened consumer; it reflects the mathematical reality that the U.S. economy simply cannot maintain its current pace of rise. Indeed, the U.S. consumer is strong. In aggregate, consumers have accumulated significant savings and wealth during the pandemic due to a host of factors, including stimulus payments, enhanced unemployment benefits, rising wages, a tight labor market, and rising asset prices. In addition, consumers spent the first portion of the pandemic paying down debts; annual U.S. total household credit card debt is at a three-and-a-half-year low. The result is a consumer able to tap into both savings and potentially loans to drive economic growth in the coming years.

Consumer strength is particularly evident in the recent data for U.S. total retail sales. Annual U.S. total retail sales are at a record high, up double digits from the year-ago level and accelerating in their ascent. The increase is not just due to inflation; it is also attributable to increased activity. The overall consumer sector is and will continue to be healthy.

Despite favorable demand-side conditions, supply-side issues remain an impediment to macroeconomic growth. Supply chain issues are resulting in shortages of certain goods, putting upside pressure on prices. This is particularly evident in sectors like the automotive industry. The market for automobiles has seen higher prices in recent months as semiconductor shortages throttle auto production. In general, the supply chain issues are likely to persist in the near term, but less-robust demand in 2022 as economic growth slows will help the supply chain untangle at least somewhat. Accordingly, pricing pressures will ease.

Another issue confronting many U.S. firms is the difficulty of finding and retaining workers in the tight national labor market. Annual U.S. private sector employment is currently 4.5% below the prepandemic peak, but not for lack of job openings or opportunities. Many workers are reluctant to re-enter the workforce due to the pandemic or difficulties finding childcare. This is causing pain for many businesses as they struggle to find qualified workers and find themselves having to compete with other firms while also contending with a narrower labor pool. It’s tempting to think these labor issues may be alleviated somewhat by the general return of in-person schooling in most parts of the U.S. and the end of enhanced unemployment benefits. However, the major driver of labor market tightness – demographics – predates the pandemic and will take many years to resolve. We urge businesses to take steps such as ensuring a topnotch workplace culture to attract and retain workers in what will be a persistently tight labor market in the coming years.

Slowing growth is not something to fear, but it is something to plan for. If you take steps to prepare your business for the lower growth rates of 2022-23, in both the overall economy and most markets, you will find yourself ahead of the competition.