AEM Optimistic on Construction, Ag Economies

From the Association of Equipment Manufacturers

While the U.S. and global economies have continued to grow, the pace has slowed over the second half of 2021. But in the construction and agriculture equipment industries, stronger-than-expected growth this year has many manufacturers feeling optimistic about 2022.

According to results from Association of Equipment Manufacturers’ fall member survey, more than 80% of AEM members anticipate rising demand for construction and agriculture equipment over the next year. Furthermore, roughly 65% think demand for ag equipment will be above normal, while 44% think demand for construction equipment will be above normal.

Manufacturers are facing some headwinds, though. More than 80% of AEM members are having a difficult time filling manufacturing positions. Roughly 95% are being affected by supply chain issues. Widespread inflation is driving up prices for raw materials and other manufacturing inputs, as well as the finished products manufacturers send to market.

Despite all of these challenges, AEM members remain optimistic. Roughly 58% in the construction segment and 44% in the agriculture segment think the global economy will recover within the next year. Roughly 70-74% think the U.S. economy will recover within the next year, and 75-80% think their individual companies will recover in a year.

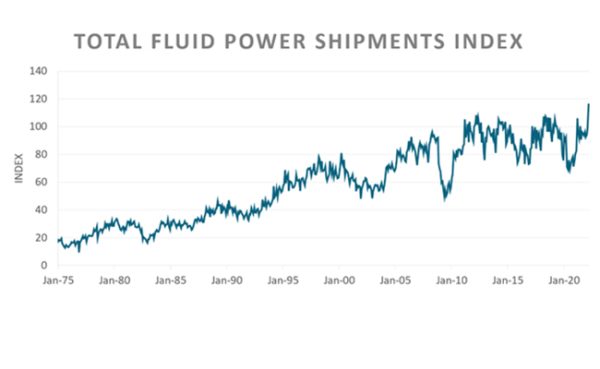

Construction industry outlook

Construction spending is up 1.1% this year. Spending should improve next year, with 2.7% growth in the forecast. If that plays out, construction spending in 2022 will surpass 2019, which was a banner year for the industry.

The construction pipeline, especially on the residential side, remains strong. The total construction pipeline has $464 billion currently under construction, $742.71 billion in pre-tender, $33.65 billion in tender, and $28.28 billion in the award/financing stage. Another $233 billion has been delayed or canceled, largely due to labor and materials shortages.

On the nonresidential side, power plants and grids have seen the most investment (30%) followed by roads and bridges (17%).

“The American Jobs Plan will give a big boost to spending on infrastructure,” said AEM Director of Market Intelligence Benjamin Duyck. “The biggest impacts will be in 2022 and 2023.”

AEM members remain quite optimistic about the CE segment, although attitudes have cooled a bit since this time last year. Nonetheless, roughly 75% of AEM members saw a jump in new orders of construction equipment in Q3. At the same time, 80% saw an increase in backlog. Roughly 42% have been able to increase production while another 42% have maintained.

With respect to construction components and attachments, 96% saw an increase in new orders while 90% watched their backlogs increase. More manufacturers (83%) have been able to increase production, however, than those on the wholegoods side.

“Demand for every construction equipment category remains green,” Duyck said.

That said, AEM members are expecting more mild growth in most categories over the next 12 months, which could be due to the fact that performance this year was much stronger than expected.

The latest data shows that machinery for mining and construction in the U.S. should finish this year with a 17.5% increase. Looking forward, 7.7% growth is expected next year, followed by 5.4% in 2023.

On a global level, Brazil has seen the most growth this year (44.8%), followed by China (24.3%), Japan (24.2%), the United Kingdom (20.7%), and India (19.4%). Looking ahead to 2022, India is expected to see the most growth (12.4%), followed by the United Kingdom (9.3%).

Agriculture industry outlook

American farmers are in a strong position despite reduced government payments in 2021.

“Net farm income is estimated to have increased by 19.6% in 2020 and is forecasted to increase another 19.5% in 2021 to $113 billion,” Duyck pointed out. “Net farm income is at its highest level since 2013 and is 20% above its 2000-2020 average.”

American farmers are also seeing their best debt-to-equity and debt-to-asset ratios since around 2004, although they are expected to decrease slightly in the coming months.

“When you look at the historical backdrop, though, U.S. farms are in a good financial situation,” Duyck said.

Farmers have been taking advantage of their good financial position to invest in new equipment. The most recent AEM data shows the following year-to-date sales growth through September:

● 2WD tractors <40 hp – 10.5%

● 2WD tractors 40-100 hp – 9%

● 2WD tractors >100 hp – 2%

● 4WD tractors – 3%

● Self-propel combines – 3%

Looking forward to 2022, growth is expected to be more controlled. AEM members feel that most key ag equipment categories will see growth similar to this year. That said, expectations are higher for some equipment categories:

● Attachments for working soil, seeding and fertilizing

● Irrigation and sprayers

● Tractors

All in all, 84% of AEM members say year-over-year wholegoods demand is rising, with another 14% saying demand is stable. The numbers are similar with respect to parts.

Looking ahead to 12-month demand planning, 65% of AEM members anticipate above-normal growth, 29% expect normal growth, and 6% think demand will be flat. Nobody thinks demand will weaken.

Q3 data shows what has already been taking place. New orders of wholegoods have been climbing for 80% of AEM members, as has the order backlog. Roughly 53% have been able to increase production, slightly more than the 47% who have held production steady.

With respect to components and attachments, roughly 94% have seen an increase in both new orders and backlog. But unlike with wholegoods, the overwhelming majority (84%) of component and attachment manufacturers have been able to increase production.

Agricultural machinery data shows that the U.S. is expected to finish this year up 21.2%. Growth next year is forecasted to be 5.2%, followed by 3.4% in 2023.

Looking at the global outlook, China’s deep contraction (-43.4%) has weighed heavily on the global market, which saw an overall decrease of 8.4% this year. Every other international market grew this year, led by Brazil (39.9%) and Russia (24.6%). Looking ahead to 2022, global growth of 6.5% is expected to be led by a rebounding China (26%), India (12.2%), the United Kingdom (9.5%), and Eastern Europe (5.7%).

Major trends affecting manufacturers

Supply chain.More than 95% of AEM members are experiencing supply chain disruptions both globally and domestically. Unfortunately, 72% think the disruptions are getting worse.

Most AEM members think supply chain issues will persist through 2022 (68% for ag, 58% for construction). A small percentage (14% ag, 11% construction) think these issues will persist beyond next year.

“Some of these issues could very well last until 2023, such as semiconductors and variable frequency drives, which basically every factory uses,” Duyck said.

AEM members are doing what they can to adapt to the current environment. Roughly 60% of ag members and 70% of construction members are making adjustments to inventory management. That represents an increase of roughly 15% compared to the previous quarter.

“Just think about all the books that might have to be rewritten when JIT (just in time) inventory management is no longer king,” Duyck said.

Inflation.Most key construction and agriculture equipment categories held fairly steady from August 2019 to August 2020. Over the past 12 months, however, it has been a much different story. The overall consumer price index climbed 5.25%. Several equipment categories rose faster than that:

● Parts for farm machinery – 12.67%

● Farm plows, harrows, rollers, pulverizers, etc., and attachments – 11%

● Mixers, pavers, and related equipment – 9.89%

● Planting, seeding, and fertilizing machinery – 8.07%

Workforce.Roughly 82% of AEM construction equipment members say they are having a difficult time filling manufacturing positions. Roughly 61% say they are having hard time filling office positions. AEM ag equipment members are having an even harder time. Roughly 87% are struggling to fill manufacturing positions while 70% are struggling to hire office workers.

AEM members are trying a variety of tactics to help recruit and retain workers. The most successful appear to be showing employees more respect, offering flexible hours, and work-from-home opportunities.

For more information, visit www.aem.org