Meeting the Challenges of Medical Processing Manufacturers

By Pat Byce, Marketing Coordinator, Spartan Scientific

As a manufacturer of fluid control products used for medical and analytical processing, Spartan Scientific faces an overabundance of evolving and complex requirements, standards, and regulations along with fierce competition always looking for an edge and the ability to stay ahead.

Over the years, the medical and analytical markets have regularly undergone positive developments and technological advancements. These devices and processes are often made up of numerous components from various manufacturers throughout the world and have a direct relationship with the advancement of the medical and analytical industries.

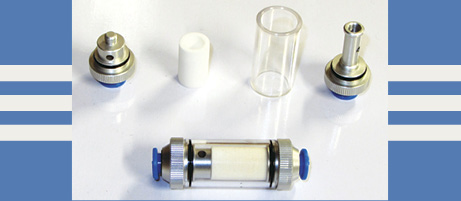

Fluid power and the ability to control a media, such as a gas or liquid, has remained a fundamental principle of medical and analytical technology. More specifically, isolation valves also known as media separated valves are frequently used in today’s medical industry and are found in many different processes and devices, mostly because of their simple functionality, cost effectiveness, reliability, and repeatability.

To understand the vital role that isolation valves play within medical markets, it’s important to understand the idea behind isolation valves and to recognize that “one size fits all” does not apply. An isolation valve is used to control the flow of a media, while ensuring the media remains isolated or separated from any contaminants or hazardous materials that could potentially cause a device failure, or even worse, put something or someone in danger. Examples of common medical medias include blood, plasma, dialysate fluid, steam, disinfectant fluid, CO2, oxygen, and water. Different media types can, and usually do, belong to different applications, which in turn requires additional variables to be considered such as valve functionality, physical size requirements, actuation or response times, seal or diaphragm materials, dead volume, and/or life span. Some examples of devices and applications that may use isolation valves include dialysis equipment, clinical sterilizers, respirators, ventilators, diagnostic equipment, and medical sanitation.

In order to stay ahead in this evolving market and because of the diverse range of isolation valve applications, manufacturers have combined their capabilities and resources to provide engineered custom solutions specifically focused on meeting critical requirements, exceeding expectations, and creating value for medical providers, practitioners, and patients.

There are many challenges that manufacturers face when designing a custom solution and it’s important that both the customer and the manufacturer have an open line of communication, with complete transparency, throughout the design and development process. Communication, or lack thereof, can dramatically drive up material, labor, and engineering costs, extend a projects timeline or release schedule, and most notably, can cause an increased probability of failure.

According to the U.S. Food & Drug Administration, “each year, the FDA receives several hundred thousand medical device reports of suspected device-associated deaths, serious injuries, and malfunctions.” Malfunctions can come from a number of different variables, and don’t necessarily derive from a fluid power component or an isolation valve. However, the FDA and other governing bodies that control the medical market, focus on and pay close attention to malfunctions, failures, and other types of issues.

After reading this quote from FDA.gov, Phil Muntean, chief engineer of Spartan Scientific, explained that “Any device or any media within a valve that can potentially come in contact with the human body necessitates additional approvals or adheres to additional standards. When discussing a new project where we’ll be engineering a custom solution, we keep in close contact with our customers and end users in order to execute any additional testing that may be involved either by our manufacturing facility or by an outside source.” Other ways to ensure an engineered solution has followed the correct testing procedures using the most up-to-date testing parameters is to gather information through market research, competitive research, or related predecessor solutions.

According to the Department of Commerce, “the United States represented about 40% of the global medical device market in 2017 and the medical industry is responsible for approximately 2 million jobs located in the U.S.” The future for manufacturers looks light a bright one, but creating value is mandatory for companies in this competitive market. To survive, manufacturers and companies alike will need to overcome future challenges pertaining to the issues like the emergence of IoT Technology, more innovative product design and product quality, regulatory compliance, and approvals.