2016 Mobile Q&A

Ken Baker is the CEO of Bailey International, with headquarters in Knoxville, Tenn., and locations in Victoria, British Columbia; Kansas City, Kans.; Reno, Nev.; and Chennai, India. Mr. Baker’s formal education is in electrical engineering at The University of Tennessee. His diverse background includes electronics design in medical imaging, complex systems engineering, lean manufacturing and process improvement, and operations and executive management.

Ken Baker is the CEO of Bailey International, with headquarters in Knoxville, Tenn., and locations in Victoria, British Columbia; Kansas City, Kans.; Reno, Nev.; and Chennai, India. Mr. Baker’s formal education is in electrical engineering at The University of Tennessee. His diverse background includes electronics design in medical imaging, complex systems engineering, lean manufacturing and process improvement, and operations and executive management.

Frank Fetty, CFPMHM, is territory manager with J.H. Fletcher and Co. mining equipment, managing all service and sales in the southeast region of the United States and Canada. He started his career in the U.S. Army as a heavy equipment mechanic, later working as a service technician for some of the biggest-named manufacturers in the field. As territory manager, Mr. Fetty is able to maintain hands-on work with equipment, either by training young service technicians or helping more experienced service technicians with extensive jobs.

Simona Onorini is product manager for Gefran, Inc., and her position is dedicated to the linear potentiometers line, as well as the new product range for mobile hydraulics applications: hall-effect rotation sensors, tilt sensors, and wire angle potentiometers. She studied economy before specializing in marketing and business communication. She started her career as a consultant working as a market trends researcher and analyst handling performance and business satisfaction programs, as well as staff training.

Simona Onorini is product manager for Gefran, Inc., and her position is dedicated to the linear potentiometers line, as well as the new product range for mobile hydraulics applications: hall-effect rotation sensors, tilt sensors, and wire angle potentiometers. She studied economy before specializing in marketing and business communication. She started her career as a consultant working as a market trends researcher and analyst handling performance and business satisfaction programs, as well as staff training.

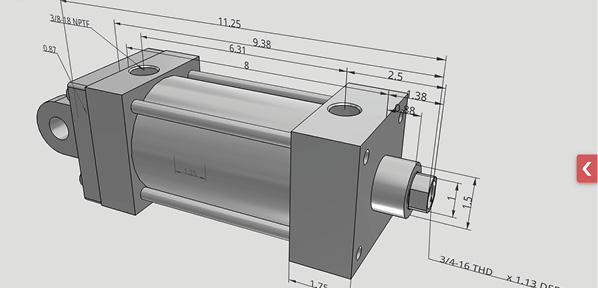

Justin Fluegel is general manager for Hengli America, a subsidiary of Hengli Hydraulic. He started his career in fluid power by taking classes at Milwaukee School of Engineering (MSOE) to earn his Mechanical Engineering degree. He designed custom hydraulic cylinders and components, and developed full industrial machines before joining Hengli. His current focus is leading his team to grow sales within the U.S. market, and finding and developing Hengli’s distribution partners within North America.

Justin Fluegel is general manager for Hengli America, a subsidiary of Hengli Hydraulic. He started his career in fluid power by taking classes at Milwaukee School of Engineering (MSOE) to earn his Mechanical Engineering degree. He designed custom hydraulic cylinders and components, and developed full industrial machines before joining Hengli. His current focus is leading his team to grow sales within the U.S. market, and finding and developing Hengli’s distribution partners within North America.

What areas of growth or opportunity do you see developing in 2016 for the domestic/and international mobile market?

Baker: The major markets for growth in the United States are in construction and transportation. Construction market growth should be in the 6-8% range, as we continue to see non-residential construction growth in infrastructure and commercial space increase. Transportation will continue to grow in the work-truck, trailer markets, and rail markets. There is a potential for small to medium agricultural equipment to see some growth this year, though large agricultural equipment will most likely not bounce back until 2017 with the return of stronger farm incomes.

Through all segments, we are seeing a lot of growth in the automation and controls section, as electro-hydraulics are used more and more commonly in the middle and smaller tiers of equipment manufacturers.

Fetty: Both domestic and international construction markets, as in new roads, bridges, and road repair, should see some growth opportunity in 2016. As a result, the stone and asphalt needed for this growth should ramp up the mining production requirements for all associated products.

Onorini: Big players populate the mobile hydraulics market. Opportunities come from companies producing big machinery, such as large excavators, tractors, and aerial platforms, as well as those manufacturing components such as cylinders.

The most interesting growth in the global hydraulic market mainly refers to some segments like the agriculture, the earth-moving equipment, and lifting applications. The worldwide sales estimations from recent market research for these segments return a value of over EUR 300 Billion. In this context, Europe represents 42% of the global market, followed by the Asian world with 40%, and finally America with 18%.

In this scenario, one of the main opportunities is linked to the growing trend of equipping machines with more and more sensing devices in order to make them more efficient and technologically advanced.

Fluegel: At Hengli, our three major market areas—North America, Europe, and Asia—have many parallels. All three are experiencing turbulent market conditions; however, we see signs of stability in the construction equipment market with a bright spot in the lift and access industry. In China, aerial work platforms and scissor lifts demand is beginning to grow as employee safety becomes more important. In the U.S. and Europe, we see slow construction and infrastructure investment stimulating demand.

What challenges in terms of technology, regulations, efficiency, productivity, etc. will the mobile market face this year, and what does the industry need to do to handle those challenges?

Baker: Efficiency and automation will continue to be a focus for U.S.-based production, as well as a drive to higher complexity solutions for U.S.-based production. Labor, as a portion of the cost of hydraulics production (in the U.S.), must continue to decrease to maintain cost competitiveness. To handle this, the manufacturers in the United States must continue to invest in process improvement and factory automation, while maintaining and improving quality of the product. This is difficult to manage in a lower market (as is forecast for the first half of 2016). This dual focus (efficiency and quality) in this economy has been our continued focus at Bailey throughout 2015 and 2016.

In addition, the technical training and advancement of our existing workforce must continue. As we advance with automation, the workforce must continue to advance and be ready.

Fetty: [A big challenge is] keeping up with technology and staying focused on improving reliability while maintaining strict guidance on effective price structure for the end user of the machines. With regulations becoming so stringent in the mining industry, it is extraordinarily difficult to keep machine prices down and yet push for newer technology. The industry needs to band together and pressure our government to loosen the current EPA’s controlling reins. It is becoming difficult to compete with foreign markets due to the fewer regulations these countries have to operate under.

Onorini: The major challenges are these:

- Efficiency: controlling all the main machine movements, such as the vehicle’s inclination, the fifth-wheel rotation, or the alignment of the platform where the operator works. The market requires solutions that can offer accurate controls to the highest number of machine movements with high repeatability.

- Intelligence: equipping the machines with advanced sensors for specialized controls. It is necessary to provide a high level of automation and digital communication (CAN J1939 protocol) in order to reduce the operator’s control and make the machines more intelligent.

- Safety: related to both the machine and the operator. The safety regulations, related to both mechanical and environmental factors, require the manufacturers to offer products capable of monitoring the vehicle operation and to report any malfunction that may compromise the reliability of the application.

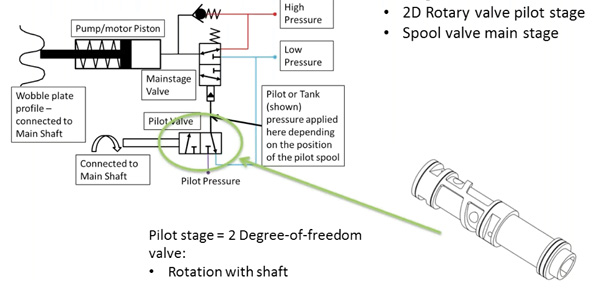

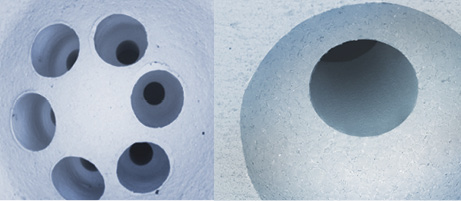

Fluegel: From piston pumps through valves and into cylinders, the expectation of performance is increasing across the market. A newer expectation is longevity of components, and Hengli has invested in research and development projects to meet those expectations: from longer service intervals to increased corrosion resistance.

From a regulation standpoint, we have already started to have conversations with customers about upcoming Tier 5 emissions standards and other countries globally increasing the environmental restraints. The challenge presented to us, a fluid power supplier, is how to provide efficient products in compact envelopes.

One of the challenges facing the mobile market is lack of technical resources for projects. This narrows the number of potential projects to many customers and slows the adoption of new technologies and products.

How can the mobile market ensure the longevity of its workforce and attract young people into the field?

Baker: Bailey has taken the challenge of internally training technically gifted personnel in hydraulics technology and process automation. By offering internal training and bonuses for completion of formal certification, we have generated significant interest in completion of the certification steps, and we support the costs of the training and testing. This will continue to be crucial as our workforce ages and retires.

We are also taking the direction of supporting hydraulics in more unusual applications to ensure that young, technical people have exposure to hydraulics in general and Bailey specifically. Engagement is critical in the newer generations.

Fetty: The way to attract young people into this field is through education. The vocational institutes need to start educating in equipment repair with a focus on hydraulics. These types of classes need to be marketed to attract the younger generation. The mentality I often see is that young people want to go to college for office-type roles, which is causing a shortage that will eventually be detrimental for the “construction and mining” industry.

Onorini: [We will attract younger talent] by developing more efficient machines, integrating more sophisticated and technologically advanced solutions that support the operator by eliminating the need of controlling some operations. The growing use of electronics in the vehicles can bring this industry to develop innovative products with advanced performance.

Fluegel: In the U.S., the knowledge base of hydraulics is more tribal in nature with limited formal programs. The IFPS provides an excellent validation of skills with its certifications; however, the challenge is the acquisition of that knowledge. Seminars and classes are available, as are books for self-study, but mentoring from experienced people in the workforce is the greatest transfer of knowledge. The experienced professionals will need to train younger entrants into the industry, requiring their longer participation in the field.

I remember in my Mechanical Engineering program at MSOE, even with its Fluid Power Institute, I was only able to take two classes focused specifically on fluid power. I compare my experience to colleagues at Hengli who have recently graduated from universities in China with degrees in Hydraulics Engineering, having studied in-depth componentry design in addition to system design and simulation. In having a clear educational path available at the university level, they are able to see clear possibilities within fluid power and mobile machinery industries. To compete globally, the U.S. fluid power community needs to establish a clear vision for middle, high school, and college students to visualize potential career paths that utilize their skills and cultivate their interests.

How can the mobile market stay competitive in 2016 and in the future?

Baker: Innovation will continue to drive the mobile market in the U.S., as we at Bailey see it. Advancement in electro-hydraulic solutions and more complex controller and controls options will be required and will impact equipment manufacturers of smaller sizes. These solutions must continue to be adopted by middle and small-tier players in the hydraulics space. We see momentum in these tiers and must maintain it. These solutions are no longer only the domain of large, tier 1, equipment manufacturers.

Fetty: For the industry to remain competitive, there needs to be urgency on retaining and educating top candidates to fill the positions in this market. We need to focus on making the market as safe and attractive as possible for young people to get involved. We have to keep striving for the most effective ways in developing new technology and offering that technology at an affordable rate.

Onorini: The market is expected to evolve in two directions: first by improving the existing technologies in order to offer better performance, then by encouraging the product innovation from the technological point of view. Both the commitments need to keep efficiency, intelligence, and safety as main objectives required by the market for their applications.

Fluegel: 2016 is going to be a challenging year. Mobile equipment customers will have a range of fluid power manufacturers from around the globe with different features and price points. As a supplier to the OEMs, Hengli is working with our customers to identify their value proposition and develop solutions to help them position themselves in the market. The idea of solution selling, either via the breadth of product offering or as alliances between complimentary suppliers, allowing them to present a package to their customer will become a differentiator. Delivering an integrated package of components, from hydraulics, electronics, sensors, and aftermarket support, will help manufacturers implement projects faster and better position their products for the future.