Manufacturing Q&A

Jeff Cox

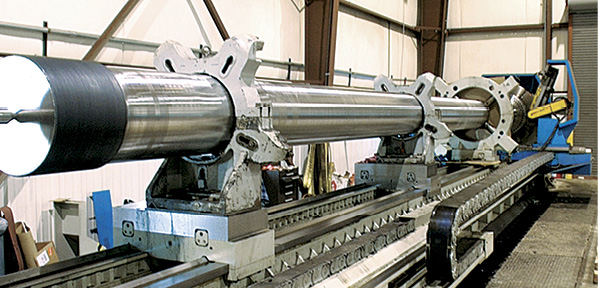

Jeff is executive vice president of Coxreels. He manages the manufacturing operation, overseeing everything related to the plant, shop floor, and production side of the business. Under his leadership, the manufacturing processes continue to evolve, with extensive use of cutting-edge technology, such as CNC machinery and robotic operations. Visit www.coxreels.com.

Thomas Reek

Thomas Reek

Thomas is the director of sales – automation – for SCHUNK, which offers worldwide technology in gripping systems and clamping technology. Mr. Reek leads a team of professional territory sales managers to achieve growth of the company’s automation products with industrial distribution partners and through direct selling. Visit www.schunk.com.

Peter Thorne

Peter Thorne

Peter is the director of Cambashi, a research analysis and consulting company. He focuses on addressing the business needs of engineering and manufacturing organizations through information and communications technology. Mr. Thorne has 30 years of

experience holding development, marketing, and management positions for both user and vendor organizations. Visit www.cambashi.com.

Are manufacturers poised for growth in the next 6-12 months? Why or why not?

Cox: I do believe that most manufacturers are poised for growth in the next 6-12 months. Although I believe the U.S. economy will improve, it will be at a slower rate than previously. Ultimately, consumer confidence and strong entrepreneurship will increase the demand for manufactured parts and products.

Reek: Absolutely! I would like to comment more on what I see in the U.S. This is the most exciting time for manufacturing. Competitiveness is the name of the game, and there is more advancement available today than ever before for U.S. manufacturers to be competitive in supply for the local markets and export. The U.S. economy is strong, and investment funds are available.

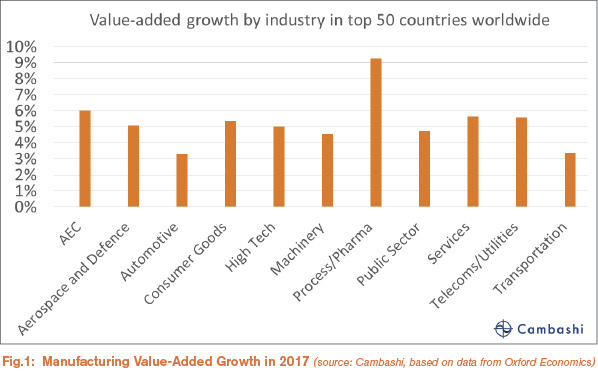

Thorne: There is variation by region and industry. The chart in Fig. 1 shows 2017 growth of value-added in the 11 sectors that Cambashi uses for its summary market numbers. GDP in a country is the sum of all value-added in that country, so VA (value-added) and VA growth figures are the first we look at to get an idea of the overall health and of industry sectors. Points we’d pick out from the chart are

a. The Process/Pharma industries are growing much faster than the average, mainly boosted by the inclusion of refineries and oil & gas extraction.

b. Automotive and manufacture of other transportation equipment (“Transportation” in the chart) grew much less than average. The big automotive countries (U.S., Germany, and Japan) are all expected to have a very tough year.

c. Manufacture of other transportation equipment (“Transportation” in the chart) also grew much less than average. A decline in Korean shipbuilding is expected, bringing the world total down.

How has the Internet of Things (IoT) impacted the state of manufacturing? Is this a positive or negative development?

Cox: The growth in connectivity of smart devices can essentially drive the need for more intelligent product development. We do not feel a direct influence on our company, per se, but I am sure there are positives for much of the manufacturing world in enabling this type of networking to exchange and gather valuable data.

Reek: The IoT does not seem to have had a great effect yet, however time is still early. Many manufacturers plan for new equipment months and years in advance, and are making plans for utilizing the IoT in new processes and machinery. The IoT is poised to make a huge impact on the efficiency of data, as well as the connectivity of machines and devices. Just think how connectivity has changed our personal lives through the smart phone; we do more personally now than ever before. There are gaps as the IoT develops, and it will take some time to close those gaps. Some gaps will be related to technology development, and many will be our ability to implement and employ the technology. It is exciting, and the gaps will close in ways that we cannot imagine.

Thorne: We’d say positive. One of the early IoT applications that has gotten a lot of attention is predictive maintenance. This ticks both cost saving (reduced downtime) and revenue (also through reduced downtime) boxes on a manufacturer’s business justification. So there are plenty of pilot projects and case studies of successes in this area.

Perhaps the most important aspect is that IoT provides a new focus for ways to find that next few percent of gains in operations—with predictive maintenance, or other examples, such as energy optimization. Also, of course, many manufacturers’ engineering and marketing teams can see potential IoT-based transformations of their businesses, ranging from new product capabilities and competitive advantage, to new business models. The last 50 years make it hard to suggest that digitization is doing anything other than continuing to accelerate, and IoT projects are probably the most direct way for manufacturers to stay part of this trend.

How is the current global economy affecting manufacturing in terms of technological innovation?

Cox: The current global economy is forcing manufacturers to embrace technological advances to improve their plant productivity. Machines are becoming smarter and easier to use, and robotics are becoming less expensive and more attainable. In order to succeed, manufacturers must be data-driven and have continuously improving minds.

Reek: The global economy is pulling manufacturers in so many ways. It could be availability of low-wage workers, availability of skilled workers, or even the availability of any workers at all. Successful manufacturers are operating globally more and more. The effects on technological innovation is the deployment and availability of the innovations in real-time, no matter where things are being made. If technology is nearly flat, the decision of where to produce will come down to other factors, many of which are positive ones like proximity to the customer. This can bring about many advantages, such as simplified supply chain, flexibility to adapt and change the product, and less environmental impact.

Thorne: The biggest factor is uncertainty. Whether it’s economic factors, like exchange rates and growth forecasts, or market factors, like demand, competition, and customer expectation, most top-table manufacturing management teams will say they believe that forecasts are subject to more uncertainty than they remember from the past. The immediate impact of this is everyone prefers variable costs over fixed costs—so, if the cancellation conditions are OK, businesses will choose the monthly subscription or similar over outright purchases, even if that increases the long-term total cost. At the leading edge, that’s driving new types of contract, closer to pay-per-use or pay-by-results. Now the interesting innovation effect of this is the fact that it shifts some risk related to reliability, also maintenance costs, from the user of equipment back to the provider of the equipment. The innovation impact of this is the new pressure it puts on providers to build machines that never break down—which is good, so long as it’s not too expensive.

What leadership strategies will help manufacturers remain competitive in the future?

Cox: There is a shortage of talent for manufacturers, and good help is difficult to find and even harder to keep. Employees are looking for more than a paycheck; they are looking for great culture and a fun, interactive work environment. Training is a critical element, along with providing opportunity for advancement.

Reek: We all must look forward and understand that gaps are forming that can rob our competitiveness. Many gaps will be related to technology, and many more will be related to skills and training. Leaders will need to have very clear employee development plans to ensure that our workforce keeps pace with technology. Looking forward will require investment in technology and people. Every day, there are growing estimates of manufacturing jobs unfilled. We have to find ways to get those jobs filled with skilled people. This will be the only way to keep pace with technology and technology adoption.

Thorne: Know your customer is still top or near the top of the list. But for some manufacturers, the growth of the value of software, both as an engineering cost and as a source of value in their products, creates quite substantial people and process issues. For these manufacturers, it’s important to find ways to make use of the opportunities that software offers to be flexible and agile, but this needs willingness to rethink planning and decision-making processes, which may have very deep roots in the organization.