Manufacturing PMI® at 47.4%; December 2023 Manufacturing ISM® Report On Business®

TEMPE, Ariz., Jan. 3, 2024, PRNewswire

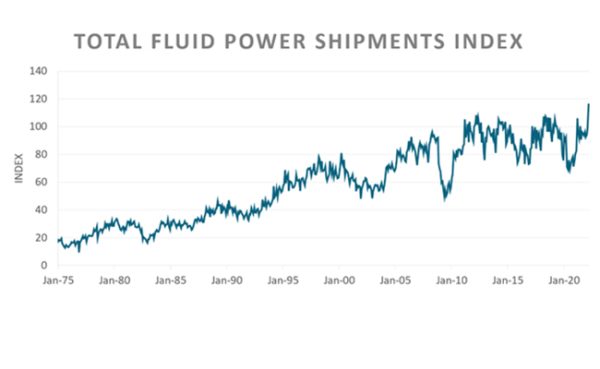

Economic activity in the manufacturing sector contracted in December for the 14th consecutive month following a 28-month period of growth, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee:

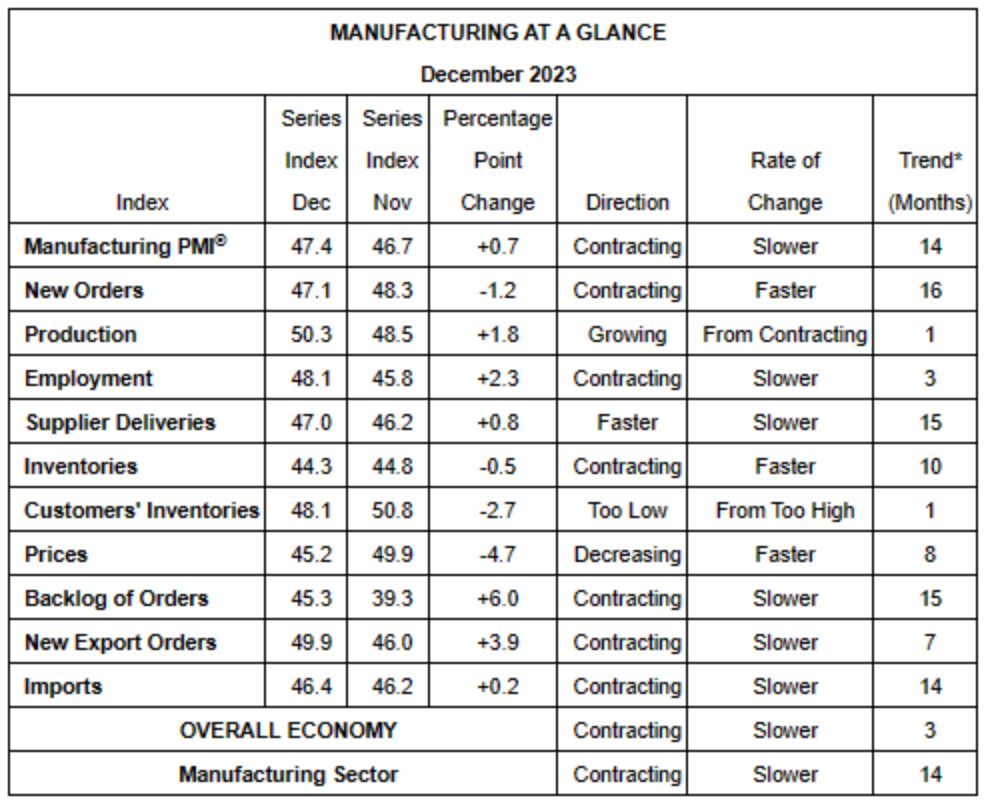

“The Manufacturing PMI® registered 47.4 percent in December, up 0.7 percentage point from the 46.7 percent recorded in November. The overall economy continued in contraction for a third month after one month of weak expansion preceded by nine months of contraction and a 30-month period of expansion before that. (A Manufacturing PMI® above 48.7 percent, over a period of time, generally indicates an expansion of the overall economy.) The New Orders Index remained in contraction territory at 47.1 percent, 1.2 percentage points lower than the figure of 48.3 percent recorded in November. The Production Index reading of 50.3 percent is a 1.8-percentage point increase compared to November’s figure of 48.5 percent. The Prices Index registered 45.2 percent, down 4.7 percentage points compared to the reading of 49.9 percent in November. The Backlog of Orders Index registered 45.3 percent, 6 percentage points higher than the November reading of 39.3 percent. The Employment Index registered 48.1 percent, up 2.3 percentage points from the 45.8 percent reported in November.

“The Supplier Deliveries Index figure of 47 percent is 0.8 percentage point higher than the 46.2 percent recorded in November. (Supplier Deliveries is the only ISM® Report On Business® index that is inversed; a reading of above 50 percent indicates slower deliveries, which is typical as the economy improves and customer demand increases.)

“The Inventories Index decreased by 0.5 percentage point to 44.3 percent; the November reading was 44.8 percent. The New Export Orders Index reading of 49.9 percent is 3.9 percentage points higher than November’s figure of 46 percent. The Imports Index remained in contraction territory, registering 46.4 percent, 0.2 percentage point higher than the 46.2 percent reported in November.”

Fiore continues, “The U.S. manufacturing sector continued to contract, but at a slightly slower rate in December as compared to November. Companies are still managing outputs appropriately as order softness continues. Demand eased, with the (1) New Orders Index contracting at a faster rate, (2) New Export Orders Index essentially flat, and (3) Backlog of Orders Index climbing back above 40 percent but still in fairly strong contraction territory. The Customers’ Inventories Index returned to contraction, becoming more accommodative for future production. Output/Consumption (measured by the Production and Employment indexes) contracted but improved, with a combined 4.1-percentage point upward impact on the Manufacturing PMI® calculation. Panelists’ companies maintained production levels month over month and continued actions to reduce head counts in December, primarily through layoffs. Inputs — defined as supplier deliveries, inventories, prices and imports — continued to accommodate future demand growth. The Supplier Deliveries Index indicated faster deliveries for the 15th straight month, and the Inventories Index moved downward while remaining in moderate contraction territory. The Prices Index dropped further into ‘decreasing’ territory, signifying soft energy markets, offset by increases in the steel and aluminum markets. Manufacturing supplier lead times continue to decrease (supported by panelists’ comments), a positive for future economic activity.

“None of the six biggest manufacturing industries registered growth in December.

“Demand remains soft, and production execution is stable compared to November, as panelists’ companies continue to manage outputs, material inputs and labor costs. Suppliers continue to have capacity. Eighty-four percent of manufacturing gross domestic product (GDP) contracted in December, up from 65 percent in November. More importantly, the share of sector GDP registering a composite PMI® calculation at or below 45 percent — a good barometer of overall manufacturing weakness — was 48 percent in December, compared to 54 percent in November and 35 percent in October. Among the top six industries by contribution to manufacturing GDP, three (Machinery; Petroleum & Coal Products; and Computer & Electronic Products) had a PMI® at or below 45 percent, the same number as the previous month,” says Fiore.

The only manufacturing industry to report growth in December is Primary Metals. The 16 industries reporting contraction in December — in the following order — are: Printing & Related Support Activities; Apparel, Leather & Allied Products; Plastics & Rubber Products; Machinery; Nonmetallic Mineral Products; Textile Mills; Petroleum & Coal Products; Paper Products; Wood Products; Fabricated Metal Products; Computer & Electronic Products; Miscellaneous Manufacturing; Furniture & Related Products; Electrical Equipment, Appliances & Components; Transportation Equipment; and Chemical Products.

WHAT RESPONDENTS ARE SAYING

- “Anticipation of the U.S. Federal Reserve holding off on interest-rate changes will encourage more companies to spend on capital investments again. As budgets get approval after the start of the calendar year, this should help drive investment and increase manufacturing activity once again.” [Computer & Electronic Products]

- “Overall, order intake has picked up over the last quarter and a backlog of projects is beginning to accumulate.” [Chemical Products]

- “Demand is up across the board. We are starting to see back orders grow again.” [Transportation Equipment]

- “Commodity costs are decreasing. Supply is readily available, and customers are still ordering to last year’s volumes.” [Food, Beverage & Tobacco Products]

- “Business is slowing. Finished goods inventories are growing.” [Machinery]

- “We are forecasting a somewhat strong year for 2024. We’re currently mildly optimistic for how next year will play out.” [Fabricated Metal Products]

- “We are seeing stronger demand from our American Automotive OEM customers now that the United Auto Workers (UAW) strike has been resolved. Looking at a very strong first quarter of 2024.” [Primary Metals]

- “Higher financing costs have diminished demand for residential investment. Customers are delaying a portion of their plans until borrowing costs are reduced. We are impacted with reduced new orders, diminished backlog of orders and uncertain short-term demand for products and services.” [Wood Products]

- “Finishing the year similar to 2022; however, 2023 was more erratic. Working to restore inventory position to ensure we have appropriate safety stock.” [Electrical Equipment, Appliances & Components]

- “Business conditions are good; sales and production are tracking in accordance with forecasts.” [Miscellaneous Manufacturing]

ISM shall not have any liability, duty, or obligation for or relating to the ISM ROB Content or other information contained herein, any errors, inaccuracies, omissions or delays in providing any ISM ROB Content, or for any actions taken in reliance thereon. In no event shall ISM be liable for any special, incidental, or consequential damages, arising out of the use of the ISM ROB. Report On Business®, PMI®, Manufacturing PMI®, Services PMI®, Hospital PMI®, and NMI® are registered trademarks of Institute for Supply Management®. Institute for Supply Management® and ISM® are registered trademarks of Institute for Supply Management, Inc.

About Institute for Supply Management® (ISM®)

Institute for Supply Management® (ISM®) is the first and leading not-for-profit professional supply management organization worldwide. Its community of more than 50,000 in more than 100 countries manage about US$1 trillion in corporate and government supply chain procurement annually. Founded in 1915 by practitioners, ISM is committed to advancing the practice of supply management to drive value and competitive advantage for its members, contributing to a prosperous and sustainable world. ISM empowers and leads the profession through the ISM® Report On Business®, its highly-regarded certification and training programs, corporate services, events and assessments. The ISM® Report On Business®, Manufacturing, Services, and Hospital, are three of the most reliable economic indicators available, providing guidance to supply management professionals, economists, analysts, and government and business leaders. For more information, please visit: www.ismworld.org.

The full text version of the Manufacturing ISM® Report On Business® is posted on ISM®’s website at www.ismrob.org on the first business day* of every month after 10:00 a.m. ET. The one exception is in January, the report is released on the second business day of the month.

The next Manufacturing ISM® Report On Business® featuring January 2024 data will be released at 10:00 a.m. ET on Thursday, February 1, 2024.