Manufacturing Q&A

Trevor O’Malley is a recent college graduate in 2012 with a BS in Mechanical Engineering. He has worked at Advanced Machine & Engineering Co. as an application engineer for the fluid power division and recently was promoted to product manager working in the design, manufacturing, and marketing of rod lock devices.

Trevor O’Malley is a recent college graduate in 2012 with a BS in Mechanical Engineering. He has worked at Advanced Machine & Engineering Co. as an application engineer for the fluid power division and recently was promoted to product manager working in the design, manufacturing, and marketing of rod lock devices.

Marti Wendel, CFPS, CFPE, is global sales manager for Curtiss-Wright, Sprague Products, a manufacturer of high-pressure hydrostatic test pumps and systems headquartered in Brecksville, Ohio. She has worked for 25 years in engineering, sales, and marketing in the fluid power industry and earned her bachelor of science at Kent State University. She is currently the IFPS president of the board and past president of the Fluid Power Educational Foundation (FPEF).

Marti Wendel, CFPS, CFPE, is global sales manager for Curtiss-Wright, Sprague Products, a manufacturer of high-pressure hydrostatic test pumps and systems headquartered in Brecksville, Ohio. She has worked for 25 years in engineering, sales, and marketing in the fluid power industry and earned her bachelor of science at Kent State University. She is currently the IFPS president of the board and past president of the Fluid Power Educational Foundation (FPEF).

Edward Stum, CFHS, PMP, SSBB, is vice president of manufacturing for RG Group. As a certified hydraulic specialist, Mr. Stum designs systems that are drafted to fluid power essential practices supported by national and international standards.

Edward Stum, CFHS, PMP, SSBB, is vice president of manufacturing for RG Group. As a certified hydraulic specialist, Mr. Stum designs systems that are drafted to fluid power essential practices supported by national and international standards.

Tim Tangredi is the chief executive officer of Dais Analytic, a nanotechnology business producing a family of membrane materials focusing on evolutionary or disruptive air, energy, and water applications.

Tim Tangredi is the chief executive officer of Dais Analytic, a nanotechnology business producing a family of membrane materials focusing on evolutionary or disruptive air, energy, and water applications.

Are manufacturing companies poised for growth in 2016?

O’Malley: I believe manufacturing in the United States will see growth in 2016. With the low energy costs in today’s economy, we see manufacturing becoming more competitive with foreign markets. This helps the economy two-fold by dumping more consumer dollars into manufacturing and allowing companies to have capital for their own future growth. This also increases confidence in manufacturing on American soil from a consumer standpoint, which only bodes well for the American manufacturing resurgence.

Wendel: Manufacturing companies are already struggling to fill positions for well-trained workers, and if there is any growth in 2016, the disparity between qualified applicants and open positions will only increase. As the experienced workforce retires, their potential replacements lack much of the basic manufacturing knowledge necessary. Many companies have internship programs with local colleges, which assist with training the engineering-level positions, but the technicians and mechanics needed to operate highly technical equipment are a little more difficult to find. One- and two-year vocational schools are a great alternative to college and allow young people to earn a fair wage without as much debt. The difficulties lie in convincing businesses that the graduates from the technical schools are a viable solution to our rising employment problems and also convincing the next generation that factory jobs are not the dangerous and dirty positions of the past.

Stum: Based on economic indicators that we follow, I expect to see moderate growth in 2016 ramping upward as we enter 2017. Our business is in several markets, all of which have potential for growth over the next 12-16 months. However, I expect global pressures to keep immediate growth tempered.

Tangredi: Yes – in total, manufacturing companies are well positioned for growth in 2016. Most U.S. companies have capacity available to meet an increase in volume. The industrial sector capacity utilization in April was 78.2%, a rate that is 1.9% below its long-run (1972-2014) average. In many cases, transportation and duties more than offset the lower labor rates available in developing countries, and therefore, local manufacturing has a supply chain advantage. This growth includes using newer materials, 3D printing, increasingly intelligent computer part/product design, and controlled processing, addressing strengths and weaknesses from greater competition from all corners of the world, pressure on margins, and a strong focus on continuously improving quality.

An area differentiating traditional manufacturing growth from long-term strategic growth is deployment-sustainable equipment and processes. This focuses on minimizing the use of increasingly precious natural resources, such as water, while working to achieve zero environmental emissions. Sustainable products and processes exist; it is imperative to challenge the dwindling natural resources and increased emissions.

Which product segments of the manufacturing market are growing? Which segments are diminishing?

O’Malley: I think the aerospace, automotive, and safety equipment industries will continue to grow in this economy. This is due to increased efficiencies in product development and manufacturing. In particular, automotive sales are increasing due to lower unemployment and increased customer spending in the marketplace. The safety market across the globe is ruled by more rigid legislation, which increases safety requirements in manufacturing plants and assemblies, which in turn drives growth. We see these shifting tides with press safety improvements, which drive sales for SITEMA safety catchers. The diminishing segments that I see are the textile and apparel sectors, which are continuing to decline due to the competition with foreign markets. This is a segment that has lost steam for a while now and continues to fall due to competition with low-cost countries like China.

Wendel: The lower gasoline price is one element increasing consumer confidence enough that it has added to the recent growth in pickup truck and SUV sales. The U.S. manufacturers that supply the automotive industry are still having difficulties keeping up with the large increase in demand, which may open up new opportunities for secondary suppliers. Supply issues may possibly be due to some fallout from the west coast labor strike. Although the strike concluded on February 20, 2015, it has taken months to rectify the backload.

Unfortunately, any manufacturing directly related to energy will continue to decline for the next few months and may not begin to recover until sometime next year. A surplus of oil, more efficient processing, fracking, and a global reduction in use have all added to the reduction in activity.

Stum: In our industry, we’re already seeing mining and gas markets, as well as military, diminishing. Industrial markets are staying flat. Power generation, mobile, and marine markets are expanding.

Tangredi: The manufacturing industry is going to have to react to external forces imposed by today’s energy landscape. For example, the drought in California is well chronicled, but really, the rest of the U.S. is facing water allocation issues, as well. Manufacturers are going to need to quickly learn how to “do more with less.” This is a good thing for manufacturers who are nimble, as well as those who can adopt new and innovative technologies, but a challenge for those who can’t. The market for older, more traditional technologies is going to become greatly diminished, as the standards associated with those technologies may not meet the standards of today.

What are the greatest challenges to manufacturing growth in the next 6-12 months, and how can companies handle those challenges?

O’Malley: With growth in the economy and the unemployment rate continuing to see a decline, the biggest problem manufacturers will face is finding skilled laborers. Finding capable employees who are knowledgeable in industrial markets and also willing to jump into the manufacturing process is key to the long-term efficiency of a company. These challenges can be overcome through knowledge management, training and development, and most important, clarity of task for each employee. Keeping data clean and organized from an operational and sales standpoint not only increases efficiencies, but also guides internal growth. Also, the job market is full of new college graduates, and apprentice programs are available (and increasing). That will help fill this void as long as Americans stay focused on developing the attractiveness of skilled trade professions to young people. By spending more on the initial training and development for a motivated individual, companies will save on retraining and the high cost of frequent employee turnover.

Stum: Our biggest challenge is in recruiting and retaining highly talented employees with the exact skill set we are looking for. Engineers with industry-leading experience and credentials are in short supply.

Tangredi: Challenges fall into four categories for small and medium-sized firms: first is the “pinch point” of retaining skilled personnel and knowledgeable vendors to build/operate the process; second is a process design balancing upfront and operating costs needed to be successful in a growing international marketplace; third is focusing on the timing of “first product produced” from the new process to begin the financial return to the business; and fourth (and growing in importance) is to construct a sustainable manufacturing process that minimizes the use of increasingly precious natural resources, such as water, while working to achieve zero environmental emissions.

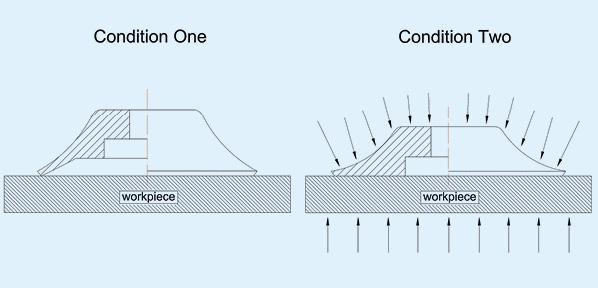

The last challenge is of particular note; “green” has lost its luster in terms of being a buzzword. The word is over-used, and some may not even take the concept seriously. This in turn damages the potential for even the most disruptive and cost-efficient technology to be deployed, defeating a key challenge point. Building in true sustainable technologies to a new manufacturing process requires education and continued decisions on the part of the entire company throughout the build process. As an example, let’s focus on HVAC systems – a key user of energy. Smart architects, mechanical engineers, or HVAC contractors are efficient at incorporating proven sustainable products into their designs, easily allowing acceptance in concert with the project’s objectives. Increased up-front costs are financially addressed over time by lower operating and compliance costs aided by local, state, or federal government programs, as well as local power producer programs. This puts added importance on the first challenge: choice of skilled personnel and vendors. Education is the key.

Are manufacturing companies doing enough to meet the energy and efficiency demands of the market?

O’Malley: I believe many newer manufacturing companies have had particularly strong initial growth and have developed modern plants that are succeeding in that aspect. However, more established manufacturing plants have a tendency to focus on growth and increased assets through conventional methods (e.g. new machinery) and less on energy efficiency. To solve this problem, operations and management should gain more knowledge on the energy consumption and efficiency opportunities within their sector. Embracing both lean manufacturing and green manufacturing will help reduce waste and clean up consumption.

Wendel: Significant improvements in energy efficiency will not come from large, systemic changes, but numerous small improvements made through “smart manufacturing.” The reduced costs of PLCs, sensors, software, and data storage have added to the explosion of smart technology embedded in the manufacturing equipment and processes. The ability to make real-time changes that can optimize raw material usage and machine efficiency while reducing scrap, utility waste, and human error will be what reduces energy consumption. These changes will not be without cost, but the long-term benefits will provide the ROI and competitive advantage needed. Many large facilities are already reaping these benefits; the small and medium-sized manufacturers will need to pursue this if they hope to survive.

Stum: I’m not sure that companies are doing enough to meet energy and efficiency demands. We offer energy-efficient systems in every market that we build for. More times than not, energy-efficient designs with long-term cost benefits are scrapped for systems with lower up-front costs.

Tangredi: While some manufacturing companies are taking great pains to improve energy efficiencies, many are not. The problem here lies within sales and economics. “Green” technology is often viewed as a tie-breaker when it comes to comparing two products. If one product is green, but more expensive than another, the purchaser is always going to go with the cheaper, non-energy efficient option. However, if the two products are the same with respect to cost and quality, then the “greener” technology retains the advantage.

One way we can change this is by addressing the importance of the green components of the technology throughout the sales process, and not just as a “but wait, there’s more” sales pitch. By explaining the long-term efficiencies and ramifications of using said greener technologies to manufacturers, these companies are in a more likely position to understand and choose that option.